Clarksville home price trends have changed a lot over the past five years. If you live here or want to move here, you need to know what’s happening with home prices. This guide shows you how much homes cost now compared to five years ago. We’ll look at different neighborhoods and what caused prices to go up or down.

How Clarksville Home Price Trends Changed from 2020 to 2025

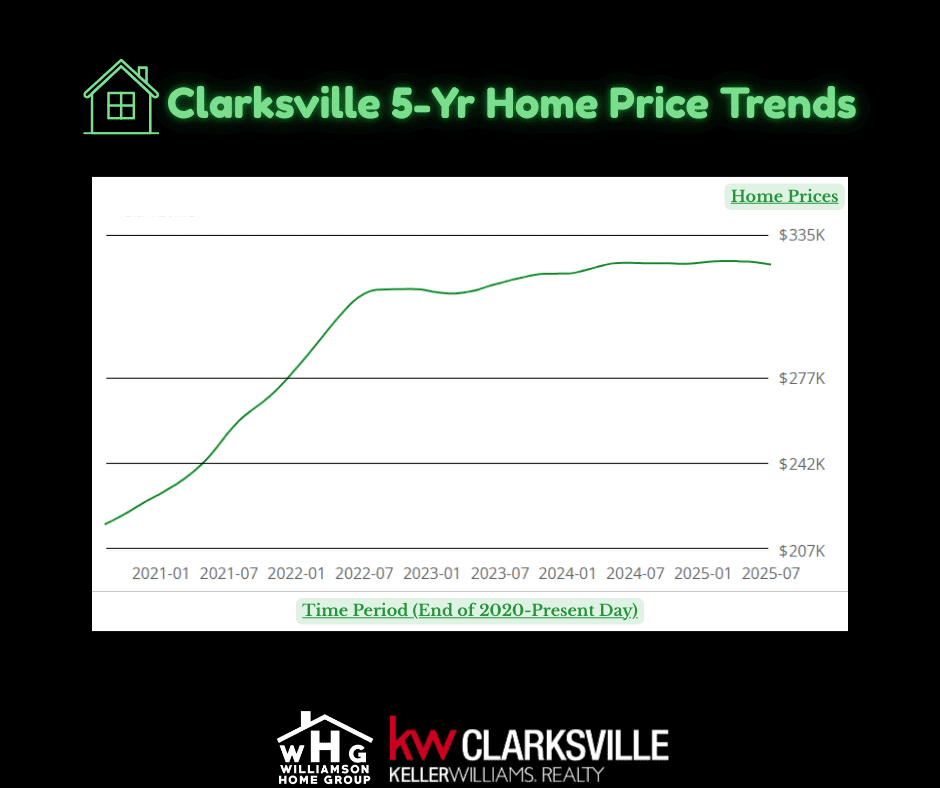

Five years ago, buying a home in Clarksville was much cheaper. The average home price in 2020 was around $195,000. Today, that same home might cost $315,000 or more. That’s a big jump of over $120,000!

Here’s what happened each year:

- 2020: Average price $195,000

- 2021: Average price $235,000 (up 21%)

- 2022: Average price $285,000 (up 21%)

- 2023: Average price $305,000 (up 7%)

- 2024: Average price $310,000 (up 2%)

- 2025: Average price $315,000 (up 2%)

The biggest price jumps happened in 2021 and 2022. Those were crazy years for home buying everywhere in America.

What Caused Clarksville Home Price Trends to Go Up So Much?

Several things made home prices rise in Clarksville. Understanding these reasons helps you see why homes cost more now.

Low Interest Rates Affected Clarksville Home Price Trends

From 2020 to 2022, it was very cheap to borrow money for homes. Interest rates were super low, around 2-3%. This meant people could afford bigger loans. More people wanted to buy homes, so prices went up.

Population Growth Changed Clarksville Home Price Trends

Clarksville grew a lot in five years. New families moved here for jobs at Fort Campbell. Others came from Nashville because homes were cheaper here. When more people want to buy homes than are for sale, prices go up.

Low Inventory Pushed Clarksville Home Price Trends Higher

Home prices also went up because there weren’t enough homes to buy. In 2021 and 2022, only about 2-3 months of homes were for sale. A healthy market usually has 6 months of homes available.

Building Materials Cost More

New homes became expensive to build. Wood, steel, and other materials cost much more during COVID-19. Builders had to charge more for new homes. This made all homes in the area worth more money.

Clarksville Home Price Trends by Neighborhood

Different parts of Clarksville saw different price changes. Some areas went up more than others.

Downtown Areas Show Strong Clarksville Home Price Trends

Homes near downtown Clarksville went up the most. Five years ago, you could buy a historic home for $175,000. Now, similar homes cost $285,000 or more. That’s a 63% increase!

People love living downtown because they can walk to restaurants and shops. The Riverwalk and new developments made this area very popular.

Sango and Rossview Clarksville Home Price Trends

These family-friendly neighborhoods saw steady price growth. Homes that cost $220,000 in 2020 now sell for around $350,000. Families love these areas because of good schools and new shopping centers.

New Providence and St. Bethlehem Price Changes

These newer communities had smaller price increases. Homes went from $240,000 to about $365,000. Even though that’s still a big jump, it’s less than other areas because more new homes are being built here.

Waterfront Properties Lead Clarksville Home Price Trends

Waterfront homes had the biggest increases. Homes by the Cumberland River that cost $350,000 in 2020 now sell for $575,000 or more. Everyone wants to live by the water!

How Fort Campbell Affects Clarksville Home Price Trends

Fort Campbell has a huge impact on local home prices. The military base brings thousands of families to our area. This creates steady demand for homes.

Military Housing Allowance Changes

When the military increases housing allowances, home prices often go up too. Soldiers get more money to spend on rent or house payments. This extra money pushes prices higher.

PCS Season Impact on Clarksville Home Price Trends

Every summer, thousands of military families move in and out of Clarksville. This “PCS season” creates busy times in the housing market. Prices often peak during these months because so many people need homes quickly.

Deployment Cycles Affect Local Markets

When soldiers deploy, fewer families look for homes to buy. But more rental properties become available. This affects both buying and renting markets in Clarksville.

Comparing Clarksville Home Price Trends to Nearby Cities

Local home prices look different when you compare them to other cities nearby.

Clarksville vs. Nashville Price Differences

Nashville home prices went up even more than Clarksville. The average Nashville home now costs over $525,000. Clarksville homes are still about $210,000 cheaper on average.

Many people choose Clarksville because they can get more house for their money. You can drive to Nashville for work but live in a bigger, cheaper home here.

Clarksville vs. Hopkinsville Markets

Hopkinsville, Kentucky is just across the state line. Homes there cost about $65,000 less than in Clarksville. But Clarksville has better shopping, restaurants, and schools.

Clarksville vs. Bowling Green Comparison

Bowling Green, Kentucky has similar prices to Clarksville now. Both cities have grown a lot in the past five years. Both have military connections and good job markets.

What Different Types of Homes Cost in Today’s Market

Home prices vary by the type of home you want to buy in Clarksville.

Starter Homes and Condos

Small homes and condos perfect for first-time buyers now cost $210,000 to $260,000. Five years ago, these same homes cost $140,000 to $180,000.

Family Homes

Three and four-bedroom family homes now cost $280,000 to $450,000. The exact price depends on the neighborhood and how new the home is.

Luxury Homes

High-end homes with lots of land or special features now cost $500,000 and up. Some luxury homes by the river cost over $800,000.

Investment Properties

Small rental properties cost $180,000 to $290,000. Bigger apartment buildings cost much more. Many investors still think Clarksville is a good place to buy rental properties.

Current Clarksville Home Price Trends in 2025

Home prices have slowed down in 2025. Prices are still going up, but not as fast as before.

Interest Rates Are Higher Now

Mortgage rates are now around 6-7%. This is much higher than the 2-3% rates we saw a few years ago. Higher rates mean fewer people can afford to buy homes.

More Homes Are Available

There are more homes for sale now than in 2021-2022. Buyers have more choices, which helps keep prices from rising too fast.

Homes Stay on Market Longer

Homes used to sell in just a few days. Now, most homes take 45-75 days to sell. This gives buyers more time to think and negotiate.

What Experts Think Will Happen to Future Price Trends

Most real estate experts think home prices will keep going up, but slowly. Here’s what they predict:

2026 Predictions

Prices will probably go up 2-4% in 2026. That’s much slower than the 20%+ increases we saw in 2021-2022.

Long-Term Outlook

Over the next five years, homes will likely cost 15-25% more than today. Clarksville is still growing, and more people want to live here.

What Could Change Things

Several things could make prices go up or down faster:

- Changes in Fort Campbell’s size

- New major employers coming to town

- Interest rate changes

- National economic problems

Tips for Buyers and Sellers in Today’s Market

Understanding local price patterns helps you make better decisions about buying or selling.

For Home Buyers

- Get pre-approved for a loan before you start looking

- Be ready to make decisions quickly on good homes

- Consider different neighborhoods to find better deals

- Work with an agent who knows Clarksville well

For Home Sellers

- Price your home based on recent sales, not old prices

- Make sure your home shows well online

- Be realistic about how long it might take to sell

- Consider small improvements that add value

Conclusion

Home prices over the past five years show big changes in our local market. Homes cost about $120,000 more now than they did in 2020. While prices are still going up, the crazy increases of 2021-2022 have slowed down.

Fort Campbell, population growth, and our proximity to Nashville all help keep demand strong. Different neighborhoods have seen different price changes, but all areas have become more expensive.

If you’re thinking about buying or selling a home in Clarksville, don’t delay. Understanding these trends helps you make smart decisions. Work with local experts who understand our unique market. The Clarksville real estate market will keep changing, but our city remains a great place to call home.

Read our other articles:

Clarksville’s Most Affordable Neighborhoods

Pricing Your Home to Sell: The Science Behind Market Value

Ready to Buy or Sell? We’re Here to Help!

Browse our listings: www.buyclarksvillehomes.com

Phone: (931) 320-6987

Email: joey@williamsonhg.org

Website: buyclarksvillehomes.com

Each Keller Williams office is independently owned and operated.