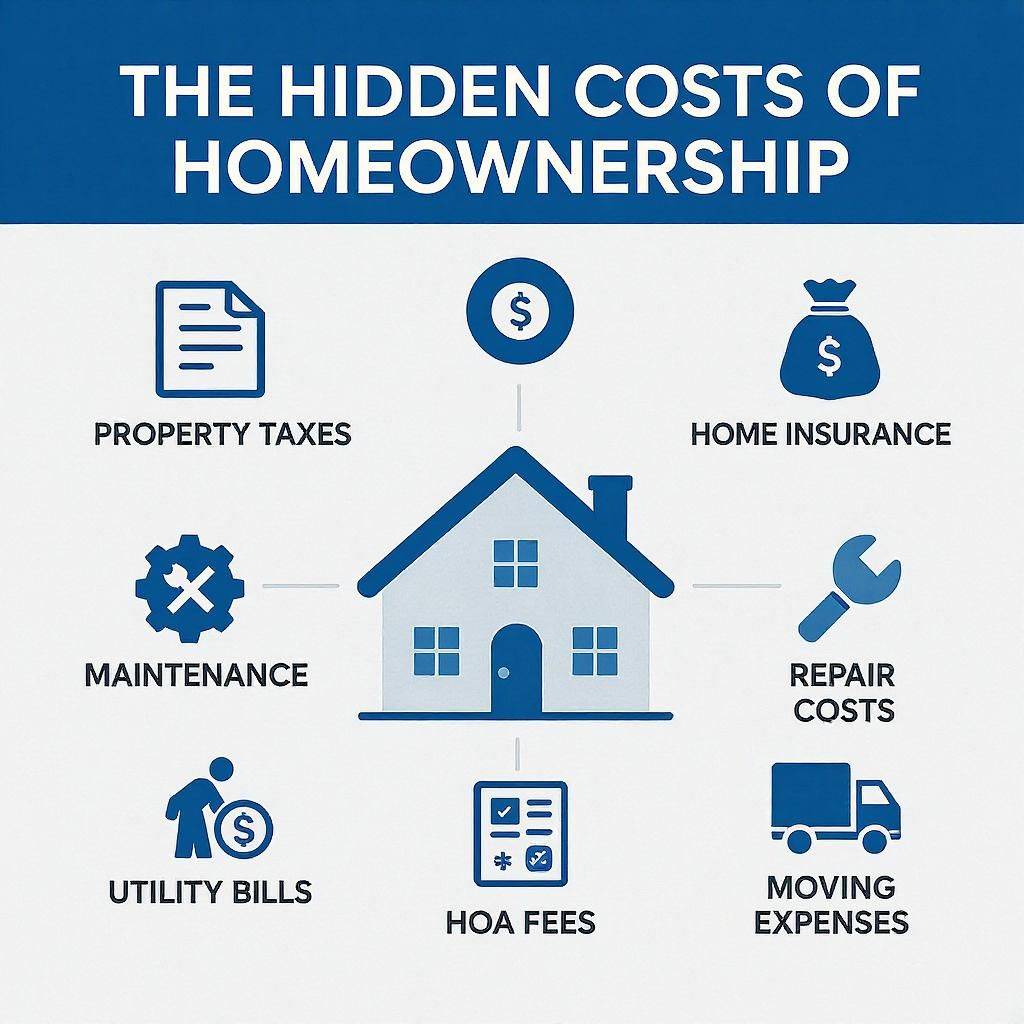

The hidden costs of homeownership can catch new buyers off guard. These expenses add up quickly and can strain your budget if you’re not prepared. Let’s break down what you really need to know before you sign on the dotted line.

Why Understanding the Hidden Costs of Homeownership Matters

Most first-time buyers focus on the big numbers. They think about the down payment and monthly mortgage. But smart homeowners plan for all the extra costs too.

These hidden expenses can add 1-3% of your home’s value each year. On a $300,000 home, that’s $3,000 to $9,000 annually. That’s real money that needs to come from somewhere.

Property Taxes: A Major Hidden Cost of Homeownership

Property taxes are one of the biggest hidden costs of homeownership. Even if your mortgage company collects them monthly, they still impact your budget.

Property taxes vary by location. Some areas charge 0.5% of your home’s value yearly. Others charge 2% or more. A $300,000 home could cost you $1,500 to $6,000 per year in taxes alone.

Here’s what makes property taxes tricky:

- They can increase each year

- Home improvements may raise your tax bill

- Tax rates can change based on local elections

Pro tip: Research property tax rates before you buy. Ask your agent about recent tax increases in the area.

Home Insurance: Hidden Costs of Homeownership Beyond Basic Coverage

Your lender requires homeowner’s insurance. But the basic policy might not cover everything you need.

Standard home insurance costs $1,200 to $2,000 yearly for most homes. But you might need extra coverage for:

- Floods (separate flood insurance required)

- Earthquakes

- High-value items like jewelry

- Home-based business equipment

The hidden costs of homeownership include these insurance gaps. Review your policy carefully. Make sure you understand what’s covered and what’s not.

Maintenance and Repairs: The Biggest Hidden Costs of Homeownership

This is where many new homeowners get surprised. Stuff breaks. And it’s expensive to fix.

Budget 1-2% of your home’s value each year for maintenance. That’s $3,000 to $6,000 on a $300,000 home. Some years you’ll spend less. Other years, you’ll spend more.

Common Maintenance Costs Include:

- HVAC system repairs ($200-$2,000)

- Roof repairs ($300-$5,000)

- Plumbing issues ($150-$1,500)

- Electrical problems ($200-$1,000)

- Appliance replacements ($500-$2,500 each)

Seasonal Maintenance Tasks:

- Gutter cleaning

- HVAC filter changes

- Lawn care and landscaping

- Exterior painting every 5-10 years

- Driveway and walkway repairs

Utilities: Monthly Hidden Costs of Homeownership

Renters often have some utilities included. Homeowners pay for everything.

Your monthly utility costs might include:

- Electricity ($100-$300)

- Gas ($50-$150)

- Water and sewer ($50-$150)

- Trash collection ($25-$50)

- Internet and cable ($75-$150)

Larger homes cost more to heat and cool. Older homes are often less energy efficient. Factor these hidden costs of homeownership into your monthly budget.

HOA Fees: Overlooked Hidden Costs of Homeownership

Many neighborhoods have homeowner associations (HOAs). These groups maintain common areas and enforce community rules.

HOA fees range from $50 to $500+ monthly. They cover things like:

- Landscaping common areas

- Pool and clubhouse maintenance

- Security services

- Exterior building maintenance (in condos)

Special assessments are extra fees for big projects. Your HOA might charge $1,000-$5,000 for roof replacement or parking lot repairs. These surprise bills are part of the hidden costs of homeownership in HOA communities.

Moving Costs: Immediate Hidden Costs of Homeownership

Getting into your new home costs money beyond closing costs.

Moving expenses include:

- Professional movers ($800-$2,500)

- Truck rental if you DIY ($200-$500)

- Packing supplies ($100-$300)

- Storage unit rental ($50-$200 monthly)

You’ll also need immediate purchases:

- New locks for security ($100-$300)

- Basic tools for maintenance ($200-$500)

- Lawn mower and yard tools ($300-$800)

- Window treatments ($500-$2,000)

- Emergency fund for unexpected issues

How to Prepare for the Hidden Costs of Homeownership

Smart buyers plan ahead. Here’s how to prepare:

Build a Bigger Emergency Fund

Renters need 3-6 months of expenses saved. Homeowners need more. Aim for 6-12 months of expenses. This covers mortgage payments and repair costs.

Get Multiple Home Inspections

A good inspection costs $300-$500. It can save you thousands by finding problems early. Consider specialty inspections for:

- Septic systems

- Wells

- Pest issues

- Structural problems

Research All Costs Before Buying

Ask your real estate agent about:

- Average utility costs

- Property tax history

- HOA fee increases

- Common maintenance issues in the area

Start a Home Maintenance Fund

Set aside money each month for repairs. Even $200 monthly adds up to $2,400 yearly. This fund prevents small problems from becoming budget disasters.

Budgeting for the Hidden Costs of Homeownership

The hidden costs of homeownership are real and significant. But they shouldn’t scare you away from buying a home. Knowledge is power. When you know what to expect, you can budget properly.

Remember these key points:

- Budget 1-3% of your home’s value yearly for hidden costs

- Property taxes and insurance are ongoing expenses

- Maintenance can’t be ignored without consequences

- Emergency funds are more important for homeowners

- Research all costs before you buy

Homeownership builds wealth over time. The key is going in with your eyes wide open. Plan for these hidden costs, and you’ll enjoy your new home without financial stress.

Read our other articles:

Finding Your Dream Home: Balancing Wishes with Reality

First-Time Homebuyer’s Guide: From Dream to Doorstep

Ready to Buy or Sell? We’re Here to Help!

Understanding the hidden costs of homeownership is just the beginning. Our experienced team helps buyers and sellers navigate every aspect of the real estate process.

Browse our listings: www.buyclarksvillehomes.com

Phone: (931) 320-6987

Email: joey@williamsonhg.org

Website: buyclarksvillehomes.com

Each Keller Williams office is independently owned and operated.